Residential mortgage how much can i borrow

For Intermediary use only. All the news you need.

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

Get a rough idea of how much you could borrow for a residential mortgage based on your personal circumstances.

. If you entered into a home loan before 23 October 2018 and havent been advised that your loan is moving to one of the above interest rate types see applicable rates here. We believe the best information about a residential development comes from the people living there. However as a drawback expect it to come with a much higher interest rate.

The higher the percentage of the total house pricevalue that you borrow the higher percentage you will pay in insurance premiums. Find out How Much You Can Borrow for a Mortgage using our Calculator. Lenders will typically need the rental income to be at least 125 of the monthly mortgage.

Whats more itll take less than a minute to complete. Use our mortgage calculator to see how much mortgage you can get in the UK how much mortgage you can afford and how much deposit you need for a mortgage. Most mortgage lenders will consider lending 4 or 45 times a borrowers income so long as you meet their affordability criteriaIn some cases we could find lenders willing to go up to 5 times income.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Our residential calculator has been built with you in mind. This mortgage finances the entire propertys cost which makes an appealing option.

These property issues can lead to a low appraisal and a mortgage denial by your lender. Total interest expenses rental property loan portion loan balance at the time of the redraw deductible interest. Tyler can claim interest of 18748 being 9300 plus.

At least for the interest rate. You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit. Your lender will give you the exact price when you apply for a mortgage.

Lenders mortgage insurance is an insurance cover that protects a lender if you cant meet required mortgage repayments and default on your loan. Your rough mortgage borrowing estimate. You can even take out a HELOC on an investment property.

Primary Residential Mortgage Inc. Lenders generally allow you to mortgage up to 80 of a homes value. Residential Mortgage Products Rates Criteria.

It can cost between 300 to 2000 but is often 1000. How much mortgage can you borrow on your salary. HomeViews collects verified resident reviews for new build homes across the UK so you can make an informed decision.

In a few exceptional cases you might be able to borrow as much as 6 times your annual income. Still setting up automated withdrawals can help homeowners who want to make additional or biweekly payments to pay off a mortgage early and cut their interest outlay. Looking to find out how much your client could borrow.

A deal with a lower arrangement fee will often have a. It will depend on your Salary Affordability Credit score. Its a lot cheaper to borrow money from a HELOC than it is from your credit cards.

How much can I borrow. 9700 355500 365000 9448. Loan to Value LTV This is the amount of the mortgage expressed as a percentage of the property value.

Could borrow on both a. Use our Residential Mortgage calculator to give you an indication of how much we could lend your clients. Unlike a residential mortgage where the amount you can borrow is based on your salary and your outgoings a Buy to Let mortgage is assessed on the rental income that the property is likely to generate.

And the needs of your customers can be too. Check rates today to learn more about the latest investment property rates. All the news you need.

If you choose to use lenders mortgage insurance to increase your borrowing power you can choose to add it to the loan balance though keep in mind this means youll pay interest on it. Mortgage lenders order property appraisals and read appraisal reports every day. Change the deposit you can provide or the amount you want to borrow to see how that affects your result.

In the example we used above you borrowed a landlord loan for 80000 leaving you to come up with the other 20000 to buy your 100000 rental property. The loan is secured on the borrowers property through a process. This is what a lender charges for setting up your new mortgage.

How to pay your mortgage. A mortgage deal with a higher arrangement fee will usually have a lower interest rate. PRMI is committed to helping our customers during this COVID-19 pandemic.

Make sure your home purchase or refinance isnt at risk. The piggyback second mortgage can also be financed through an 8020 loan structure. R - the monthly interest rateSince the quoted yearly percentage rate is not a compounded rate the.

Find and compare investment property mortgage rates and choose your preferred lender. Owners and tenants have a lot of useful information to share with their prospective. How much could I borrow on a Buy to Let mortgage.

While every mortgage lender has their own criteria for determining how much you can borrow they all look at the following key factors when calculating a buy to let mortgage. The more common of the two is the 801010 mortgage arrangement in which the home buyer is granted an 80 percent loan-to-value LTV on the primary mortgage and 10 percent LTV on the second mortgage with a 10 percent down payment. Calculate your monthly mortgage repayments to see what you could afford to borrow when moving house remortgaging or buying your first home.

The CMHC Mortgage Loan Insurance premium is calculated as a percentage of the loan and is based on the size of your down payment. To work out how much interest he can claim he does the following calculation in respect of the period following the redraw. LMR 250 As of 11 August 2022 For Intermediary use only.

Find out more in our Guide. When it comes to residential purchases the minimum deposit requirement is 5-10. A Residential Owner Occupied rate or Residential Investor rate will apply.

See the average mortgage loan to income LTI ratio for UK borrowers. A residential appraisal for a single-family home is a routine part of the home buying process. The fixed monthly payment for a fixed rate mortgage is the amount paid by the borrower every month that ensures that the loan is paid off in full with interest at the end of its term.

If you are experiencing a financial hardship as a result of COVID-19 which is impacting your ability to make your mortgage payment please reach out to our Home Retention Team at 866 609-6552 so we can assess your. As a specialist mortgage lender were here for you to help them succeed. The monthly payment formula is based on the annuity formulaThe monthly payment c depends upon.

The percentage that you can borrow via a home equity loan varies and depends on how much of the home you own outright.

Small House Designs Two Story And 1 1 2 Story Houses Central Mortgage And Housing Corp Free Download Borrow And Streaming Internet Archive Small House Design Small House House Design

A Home Loan Or Mortgage Is When You Borrow Money From Another Person Or Institution To Pay For A Property Gettos In 2022 The Borrowers Borrow Money Home Loans

Reverse Mortgages What To Know Visual Ly Reverse Mortgage Mortgage Info Mortgage Marketing

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

How Much Can You Save By Paying Off Your Mortgage Earlynever Realized That Pa Payoff Mortgage Paying O Pay Off Mortgage Early Mortgage Payoff Mortgage Tips

Wondering How Much Home You Qualify For Interest Rates Have A Big Impact On Your Ability To Borrow Lea Fixed Rate Mortgage The Borrowers Real Estate Services

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

12 Things Canadians Don T Know About Second Mortgages Canadian Mortgages Inc

How Fannie Mae And Freddie Mac Work Fannie Mae Borrow Money Understanding

What Is Loan Origination Types Of Loans Personal Loans Automated System

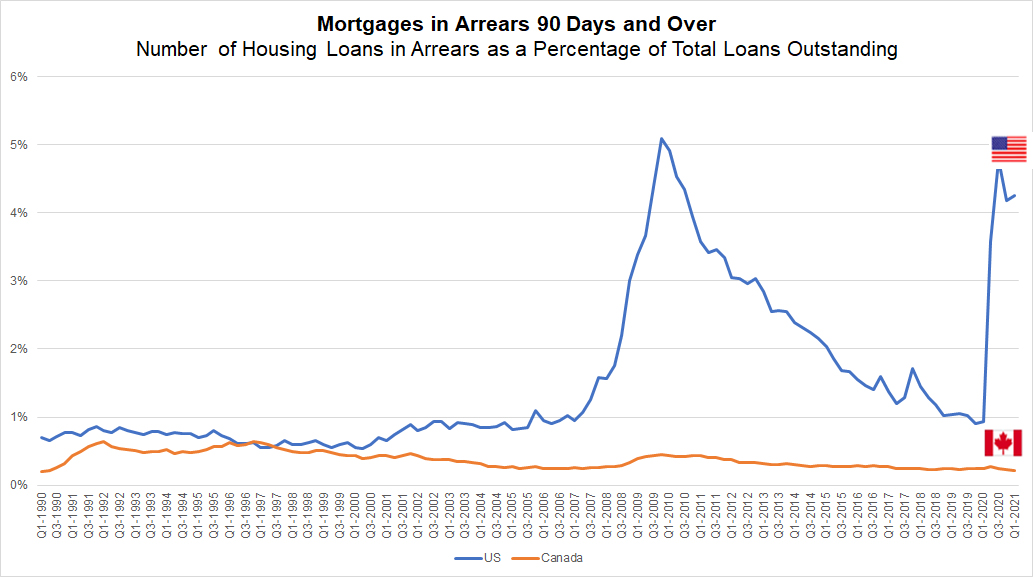

Focus Household Borrowing In Canada Focus Household Borrowing In Canada

How A Change In Mortgage Rate Impacts Your Homebuying Budget Mortgage Rates Budgeting Home Buying

Use The Interactive Home Loan Calculator To Calculate Your Home Loan Emi Mortgage Amortization Calculator Mortgage Loan Originator Mortgage Payment Calculator

Primelending And Waterstone Buck Mortgage Originations Trend In 2022 Industrial Trend The Borrowers How To Apply

Mortgage Do S And Don Ts Mortgage Mortgage Tips Mortgage Advice

Feeling That Homeowner Fomo Here Are Some Tips On How To Get Started With The Home Buying Process Home Buying Process Home Buying Home Financing

Is A Mortgage Considered Debt Mortgage Consumer Debt Finance Guide